portland oregon sales tax rate 2020

In the Portland Metro area mill-rates range from 1500 to 2030. That means that your homes value may stay the same this year or even go down a little bit but in the parallel universe of Oregon property taxes the value is still going up 3.

Sat Open House Craftsman Style Home Real Estate Lincoln City

The mill-rate varies from one community to another.

. Sales tax region name. Oregon cities andor municipalities dont have a city sales tax. 2022 Oregon state sales tax.

An In-Depth Guide Sales taxes The Portland Oregon general sales tax rate is 0. Multnomah County Business Income Tax rate. A City county and municipal rates vary.

The County sales tax rate is. These Oregon businesses will need to collect and pay sales taxes to the sales tax states if they meet the requirements. Portland Oregon Over the years the tax.

A home tax assessed at 242000 a real market value of 390K with a mill-rate of 1640 would owe annual property taxes of 3968. The sales tax rate does not vary based on county. Other FeesSurcharges Residential Rental Registration RRR Fee.

City of Portland Business License Tax rate. Instead of the rates shown for the Portland Tourism Improvement District Sp tax region above the following tax rates apply to these specific areas. The state sales tax rate in Oregon is 0000.

The minimum combined 2022 sales tax rate for Portland North Dakota is. Did South Dakota v. The current sales tax rate in Oregon OR is 0.

Please complete a new registration form and reference your existing account 3. The most populous location in Oregon is Portland. The 2018 United States Supreme Court decision in South Dakota v.

View County Sales Tax Rates. The average cumulative sales tax rate in the state of Oregon is 0. Fast Easy Tax Solutions.

Exact tax amount may vary for different items. The Wayfair decision does affect Oregon businesses selling products online to buyers in a state such as South Dakota that requires online retailers to collect sales tax. 10-01-2015 1014 AM Oregon Real Estate Transfer Taxes.

Ashland for example has a 5 local sales. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. What is the sales tax rate in Portland North Dakota.

View City Sales Tax Rates. The minimum combined 2022 sales tax rate for Portland Oregon is. If you are an Oregon online retailer with customers.

The tax will apply to tax years beginning on or after January 1 2019. The lower three Oregon tax rates decreased from last year. There are six additional tax districts that apply to some areas geographically within Portland.

Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. The most populous county in Oregon is Multnomah County. The Portland sales tax rate is.

There is no applicable state tax. Required every tax year. Business Tax Rates and Other FeesSurcharges Business Tax Rates.

Despite the lack of a state sales tax Oregon was named one of Kiplingers Top 10 Tax-Unfriendly States for Retirees in 2011 for having one of the highest personal income tax rates in the country. Portland Tourism Improvement District Sp. According to Metro the current average assessed value of a Portland home is just 231000.

Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or local level. Honolulu Hawaii has a low rate of 45 percent and several other major cities including Milwaukee and Madison Wisconsin keep overall rates modest. California 1 Utah 125 and Virginia 1.

There are no local taxes beyond the state rate. The cities and counties in Oregon do not impose any sales tax either. For more information and a flowchart to determine if vehicle use tax is due.

Did South Dakota v. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. Portland Oregons Sales Tax Rate is 0 Tax ceo oregon portland - Endoregondeathtax Why doesnâ t Oregon have a sales tax.

Metro Supporting Housing Services SHS Business Income Tax rate. Sales tax About sales tax in Oregon Oregon doesnt have a general sales or usetransaction tax. The North Dakota sales tax rate is currently.

2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000 Joint and Head-of-Household 7200 7200 - 18100 18100-250000 250000. Start a trial Contact sales. B Three states levy mandatory statewide local add-on sales taxes at the state level.

The County sales tax rate is. But assessed value still has a long way to go to catch up to real market value. Wayfair Inc affect Oregon.

This is the total of state county and city sales tax rates. Start managing your sales tax today. Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Oregon Income Tax Rate 2020 - 2021. Tax rates last updated in January 2022. The Oregon sales tax rate is currently.

These rates are weighted by population to compute an average local tax rate. This takes into account the rates on the state level county level city level and special level. Ad Find Out Sales Tax Rates For Free.

Portland voters approved Measure 26-210 to impose 1 tax to fund mental healthcare case management job training and other services for people experiencing or at risk of being homeless. The Portland sales tax rate is. To this end we show advertising from partners and use Google Analytics on our website.

Nor Portland Oregon impose any state or local sales taxes. Oregon cities andor municipalities dont have a city sales tax. This is the total of state county and city sales tax rates.

The Portland Oregon general sales tax rate is 0. State Local Sales Tax Rates As of January 1 2020. Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion.

Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire. Last updated April 2022. Automate sales tax calculations reporting and filing today to save time and reduce errors.

Taxation Of Social Security Benefits Mn House Research

State Taxation As It Applies To 1031 Exchanges

States With Highest And Lowest Sales Tax Rates

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Sales Taxes In The United States Wikiwand

Why Does Sales Tax Vary From State To State Quora

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Oregon S Cannabis Industry Could Be More Vulnerable Than Ever Portland Gov

Sales Taxes In The United States Wikiwand

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

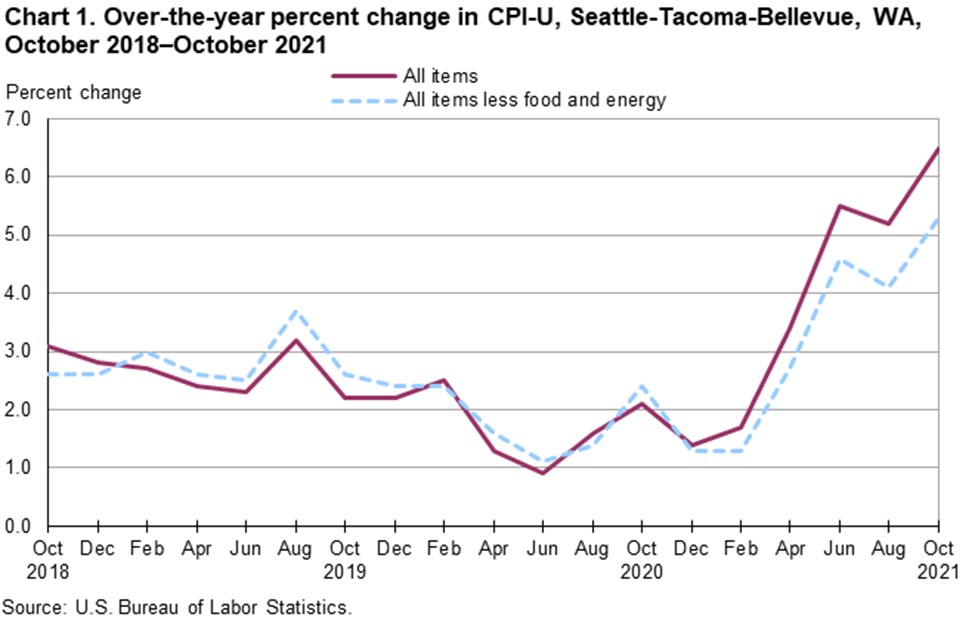

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

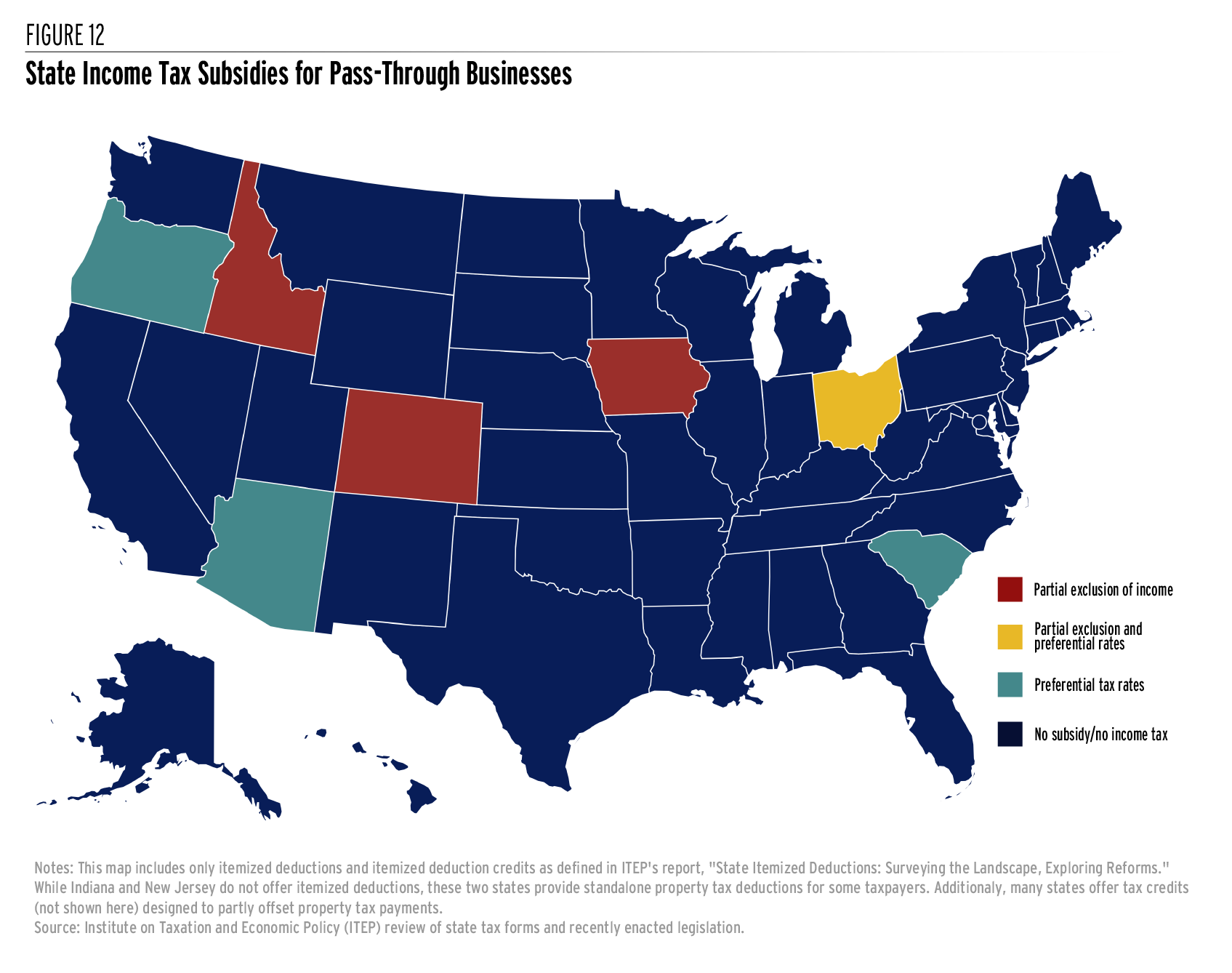

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

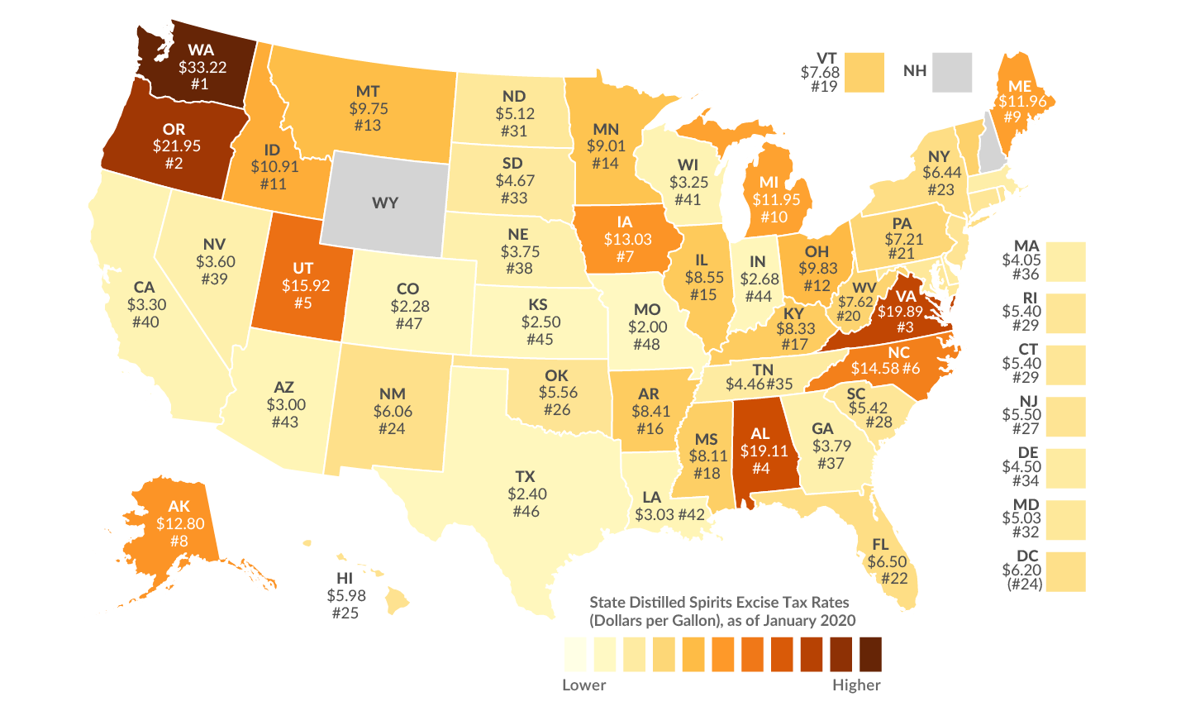

Study Washington Oregon Have Highest Taxes On Liquor In The U S Local Bigcountrynewsconnection Com